thecryptoecho

Pulse is coming to BASE via 9mm - wen PLS-wXCH?

Introduction

I don't know anything about PulseChain.

If any of you Orange Heads are going to give me a hard time,

when I screw up with the wrong information,

I'll make sure you end up with ONE EYE with my 9mm.

Be nice, I don't get paid for my videos and I don't ask for donations.

I've been writing the wrong info on Chia for over a year now,

And the Chia community is awesome and forgiving.

OrangeGooey says the PulseChain's DEX, 9mm is going to build on BASE.

The PulseChain Tokens are going to have liquidity including Chia wXCH.

OrangeGooey then provides a link to the 9mm Bible, the Orange Paper.

I'm not going to go over the entire Orange Paper, it's here for you to read yourself

https://x.com/OrangeGooey/status/1798504402740777120

Instead, I just want to introduce to my followers some information on PulseChain,

Where they are, and where they are heading, and a big piece of the story is 9mm, BASE, and Uniswap.

Feel free to use the Table of Contents to skip to any section of the blog.

For the guys who are watching the video on YouTube or on X,

You're going to suffer.

Table of Contents

The Orange Paper

- PulseChain is a full-system state fork of Ethereum

- 9mm launches a DEX on PulseChain https://9mm.pro/

- 9mm plans to launch their V2/V3 DEX on BASE

Base is a Layer 2 EVM developed by Coinbase - 9mm will join Uniswap

- A revenue sharing plan is in place to attract liquity

PulseChain is the mother of all forks

- PulseChain is a fork of Ethereum, but not just any fork. It's a full-system state fork, meaning it replicates the entire state of the Ethereum blockchain, including all the transactions, smart contracts, and user accounts. It's like Ethereum's twin brother, but with a few key differences.

- One of the main differences is that PulseChain aims to be faster and cheaper than Ethereum. It uses a Proof of Stake (PoS) consensus mechanism, which is more energy-efficient and cost-effective than Ethereum's Proof of Work (PoW) mechanism. This means that transactions on PulseChain should be faster and cheaper than on Ethereum.

- Another difference is that PulseChain has a native token called PLS, which is used to pay for transactions and incentivize validators to secure the network. PLS is also used to reward users who hold Ethereum-based tokens on the PulseChain network.

9mm is the DEX on Pulsechain

9mm is a decentralized exchange (DEX) on PulseChain, and it's not just any ordinary DEX. It's like the Usain Bolt of DEXs, aiming to be faster, cheaper, and more efficient than its competitors.

- Speed and Efficiency: 9mm is built using v3, which means it's optimized for capital efficiency and reduced slippage. That means you can swap tokens in a flash, with minimal fees and maximum returns.

- Liquidity Providers: If you're into providing liquidity, 9mm has got you covered. You can add liquidity to pools and earn fees based on the trading volume. And if you're feeling adventurous, you can even set your own range for the price deviation, so you can earn fees while the price is within your chosen range.

- PulseChain Integration: 9mm is part of the PulseChain ecosystem, which means it's built on top of the PulseChain blockchain. This gives it access to the vast liquidity and user base of the PulseChain network.

- Community-driven: The 9mm community is a passionate bunch, and they're always looking for ways to improve the platform. They've got a strong presence on social media, with active discussions and a thriving community.

What do they mean V2 and V3 DEXes?

V2 and V3 DEXes refer to different versions of decentralized exchanges, which are platforms that allow users to trade cryptocurrencies directly with each other without the need for a central authority.

V2 DEXes:

- These are the earlier versions of decentralized exchanges.

- They typically use a simple liquidity provision model where liquidity providers (LPs) deposit an equal amount of two different tokens into a pool.

- The price of each token in the pool is determined by a constant product formula, ensuring that the relative supply and demand of each token is reflected in the exchange rate.

- LPs earn fees from trades that occur in the pool.

- Examples of V2 DEXes include Uniswap V2, SushiSwap V2, and PancakeSwap V2.

V3 DEXes:

- These are the newer versions of decentralized exchanges.

- They introduce several innovations, including concentrated liquidity and flexible fees.

- Concentrated liquidity allows LPs to choose the price ranges they want to provide liquidity for, instead of covering the entire curve. This can lead to higher returns for LPs.

- Flexible fees allow LPs to set their fees based on the perceived risk of the token pairs they provide liquidity for.

- Examples of V3 DEXes include Uniswap V3, SushiSwap V3, and PancakeSwap V3.

In summary, V3 DEXes are generally more capital efficient and offer more flexibility to LPs, while V2 DEXes are simpler and easier to use.

Building the 9mm BASE

- Why are they building on BASE? Well, BASE is a new layer 2 scaling solution for Ethereum that promises faster and cheaper transactions. It's like putting a turbocharger on your DeFi engine.

- By building on BASE, 9mm can take advantage of its lightning-fast transaction speeds and low fees. This means you can trade tokens in a flash, without worrying about high gas fees eating into your profits.

- But wait, there's more! BASE also has a built-in bridge to Ethereum, which means 9mm can easily tap into the vast liquidity and user base of the Ethereum network. It's like having a direct line to the DeFi buffet.

- How will 9mm be connected to BASE? Well, it's like a symbiotic relationship. 9mm will use BASE's infrastructure to power its DEX, block explorer, and NFT marketplace. In return, BASE gets a shiny new DeFi project to showcase its capabilities.

- In conclusion, 9mm building on BASE is a match made in DeFi heaven. It's like peanut butter and jelly, or Batman and Robin. Together, they'll bring fast, efficient, and secure trading to the masses.

Next Stop Uniswap

- So, why do they want to connect to Uniswap next? Well, Uniswap is one of the most popular decentralized exchanges on Ethereum, with a massive user base and tons of liquidity. By connecting to Uniswap, 9mm can tap into this liquidity and user base, which means more trading volume and more profits for everyone involved.

Conclusion

9mm is building on BASE to take advantage of its fast, cheap transactions, and then connecting to Uniswap to tap into its massive liquidity and user base.

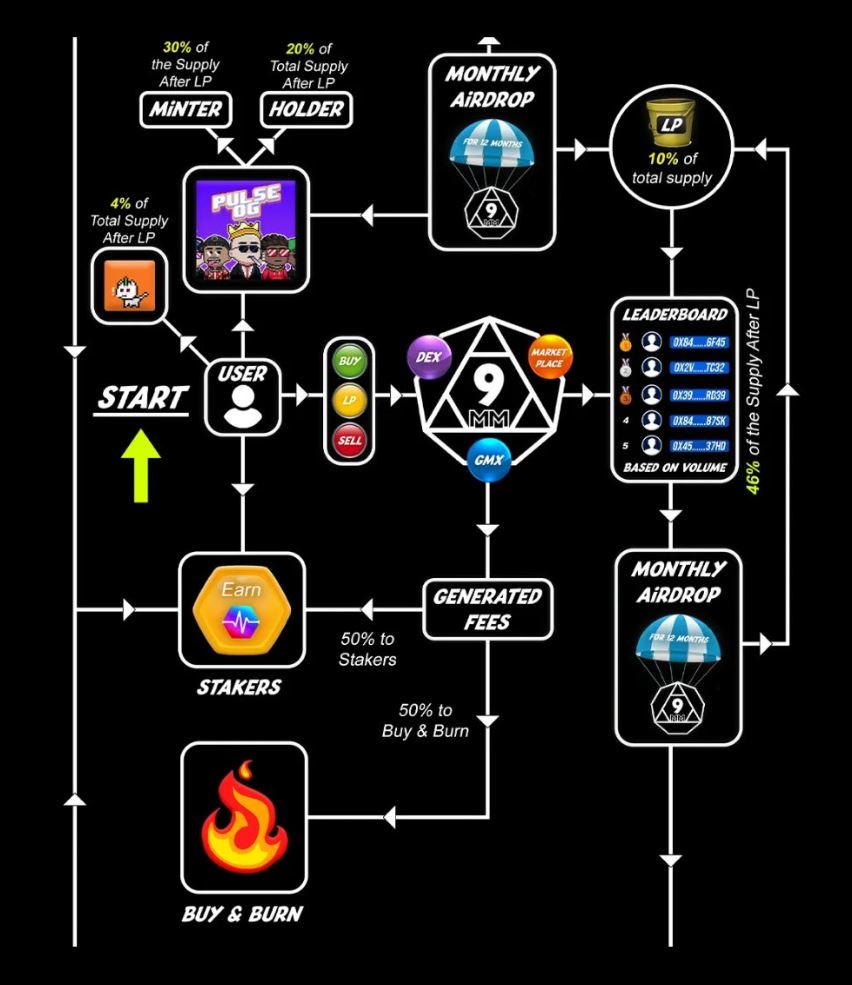

Follow the Money for Rewards

This nice diagram is a little too complicated for me to follow and explain. Here's my short version

9mm earns fees, they get routed back to the revenue share contract on PulseChain and pays PLS.

50% of the omni-chain fees are used to buy and burn $9mm supply,

while the remaining 50% is paid directly to stakers of the protocol token.

wen wXCH Pool

It's not in the Orange Paper but the PulseChain and Chia community are very intertwined in the crypto space.

You can see the similar asset tokens and the same meme enthusiam in both communities.

OrangeGooey did mention in his post that there will be a liquidity pool with wXCH and for the Chia community, this is another great way to build their global brand.

Until then, keep building that wXCH/USDC Pool on Aerodrome Finance.

wen TangGang on ABA on BASE?

On a final note, I'm a fan of the ABA Project and their team and would like to see the TangGang start minting NFTs and hope there will be another video when ABA is ready to build on BASE.

Get in early everyone, the ABA blockchain is just a couple of months old and it's an opportunity to get in on the ground floor.

What's Next?

My YouTube channel is dead because I make shit videos, so I don't make videos except for Tom Pepe/TangGang and the ABA Project.

If the PulseChain finds any value in my videos, DM me, everyone loves me because I work for free. in my spare time.