thecryptoecho

The Complete Guide to Earning as a Chia Liquidity Provider

Introduction

In the evolving landscape of blockchain technology, the Chia network emerges as a unique platform that combines the robust security of the UTXO model with the flexibility of smart transactions. For those interested in deepening their engagement with this innovative ecosystem, becoming a liquidity provider represents a valuable opportunity.

As a liquidity provider on the Chia network, you embark on a journey that not only contributes to the network’s stability but also positions you at the forefront of decentralized finance (DeFi). The role involves staking assets into a liquidity pool, which facilitates seamless trading by ensuring there’s always a counterparty for transactions.

If you are already familiar in providing assets as an LP, use the Table of Contents below to jump to the section that you are interested in.

Table of Contents

Chia: Give me Five

Five quick reasons why you should be interested in Chia

- Innovative Consensus Mechanism: Chia uses a unique consensus mechanism called Proof of Space and Time (PoST), which is a novel alternative to the traditional Proof of Work (PoW) and Proof of Stake (PoS) mechanisms. It’s designed to be more energy-efficient and environmentally friendly

- Lower Energy Consumption: Chia’s PoST consensus algorithm significantly reduces the energy demands compared to PoW cryptocurrencies, making it a greener option in the crypto space.

- Smart Transaction Capabilities: Chia is not just a cryptocurrency; it also supports smart transactions. It was created to make cryptocurrency transactions easier and safer than traditional cash transactions.

- Decentralization and Security: Chia claims to offer better security due to its more decentralized blockchain. This could potentially lead to a more robust and secure network.

- Technological Advancements: Chia has introduced new core technologies such as BLS Signatures, Verifiable Delay Functions (VDFs), and their own Proof of Space and Time for Nakamoto consensus. These advancements could contribute to the development and adoption of new blockchain technologies.

Bridges to Riches

Over the short history of crypto, there has always been one distinct pattern, the Bridges to Riches theme. Projects will bridge to the Ethereum Virtual Machine (EVM) and open up the greateat crypto treasures. Every tool is available to their chain, the most widely used wallet integration with MetaMask, and access to 90% of the crypto buying power in the markets. In a short period of time, the isolated island of a project becomes a global player and the rest is up to the team, their partners, and the community to sell their goods, services, and differentiate their technology.

Ready for Warp

The Warp.green bridge is a messaging protocol that facilitates the transfer of assets between the Chia blockchain and other blockchains.

- Cross-Chain Functionality: It allows for bridging assets from blockchains like Ethereum’s Layer 2 (L2) networks to the Chia blockchain, and vice versa.

- Open-Source Project: The bridge is an open-source initiative and can be found on GitHub.

- Not Affiliated with Chia Network Inc.: Warp.green, the developer of the bridge, operates independently from Chia Network Inc.

- Potential for Expansion: Often referred to as an ETH bridge, it’s actually an EVM-XCH bridge, meaning it could support other EVM chains and bridge many more assets into the Chia ecosystem.

- Development and Updates: Warp.green continues to update and provide sneak peeks into the bridge’s development, indicating an active project with ongoing improvements.

This bridge represents a significant step towards interoperability in the blockchain space, making it easier for users to move assets across different platforms.

The New Cool Guy: wXCH

Wrapped XCH (WXCH) is a token that represents Chia (XCH) on the Ethereum blockchain. It’s similar to other wrapped tokens like Wrapped Bitcoin (WBTC), and it’s designed to bridge the Chia blockchain with the Ethereum ecosystem.

- ERC20 Standard: WXCH adheres to the ERC20 token standard, which is widely used for creating and issuing smart contracts on the Ethereum blockchain.

- Liquidity and Accessibility: By wrapping XCH into WXCH, it brings greater liquidity to the Ethereum ecosystem, including decentralized exchanges (DEXs) and financial applications. This makes it possible to use XCH for token trades on platforms that operate within the Ethereum network.

- Minting and Burning Process: The process of creating new WXCH tokens is called minting, which is initiated by a broker and performed by a custodian. Conversely, burning is the process of redeeming XCH for WXCH tokens, effectively reducing the supply of WXCH.

- Integration with DeFi: WXCH can increase the liquidity of the XCH token and tap into the decentralized finance (DeFi) world, allowing for more diverse financial applications and use cases.

- Smart Contract Functionality: The ERC20 format standardizes XCH, making it easier to write smart contracts that integrate Chia token transfers. This simplifies the process for exchanges, wallets, and payment apps, as they only need to handle an Ethereum node.

WXCH represents an important step in increasing the interoperability between Chia and other blockchain ecosystems, particularly Ethereum’s, by allowing Chia to be used in a wider range of applications and services.

Earn as a Liquidity Provider on Aerodome Finance

Aerodrome Finance is a decentralized finance (DeFi) project that operates as a central liquidity hub on the Base network.

- Next-Generation Automated Market Maker (AMM): Aerodrome Finance incorporates advanced features from Velodrome V2, aiming to provide a seamless trading experience and efficient token swaps.

- Liquidity Incentive Engine: The platform has a robust liquidity incentive engine that rewards liquidity providers with AERO token emissions. This encourages users to supply liquidity to the platform.

- Vote-Lock Governance Model: Aerodrome employs a vote-lock governance model where participants can lock their AERO tokens to receive veAERO NFTs. These NFTs grant voting power for emission distributions and entitlement to trading fees.

- Epoch-Based Rewards: The platform distributes emissions and rewards in epochs. LPs receive emissions based on the votes their pools accumulate, incentivizing long-term commitment and participation.

- Cost-Efficient Liquidity Building: veAERO voters have the power to decide which liquidity pools will receive AERO emissions. This democratic approach ensures that resources are directed towards the most valuable and impactful pools.

As an LP on Aerodrome Finance, you would provide liquidity to the platform by depositing assets into liquidity pools. In return, you would receive a portion of the trading fees generated by the pool and AERO token emissions. This role is crucial for the AMM to function, as it ensures there is enough liquidity for users to trade without significant price slippage. If you’re considering becoming an LP, it’s important to understand the risks, such as impermanent loss, and to stay informed about the governance decisions that could affect the rewards and operations of the liquidity pools.

How to Provide Liquidity to the wXCH/USDC Pool

It's time to pay attention and start your journey as a Liquity Provider (LP)

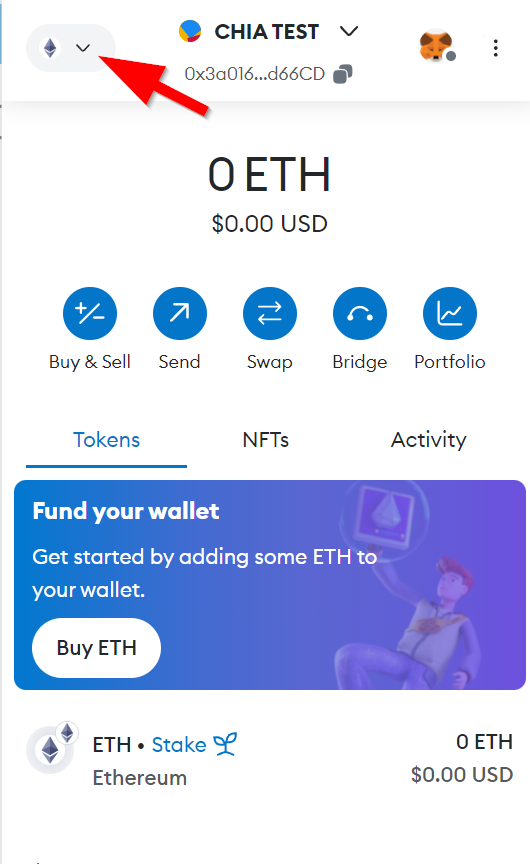

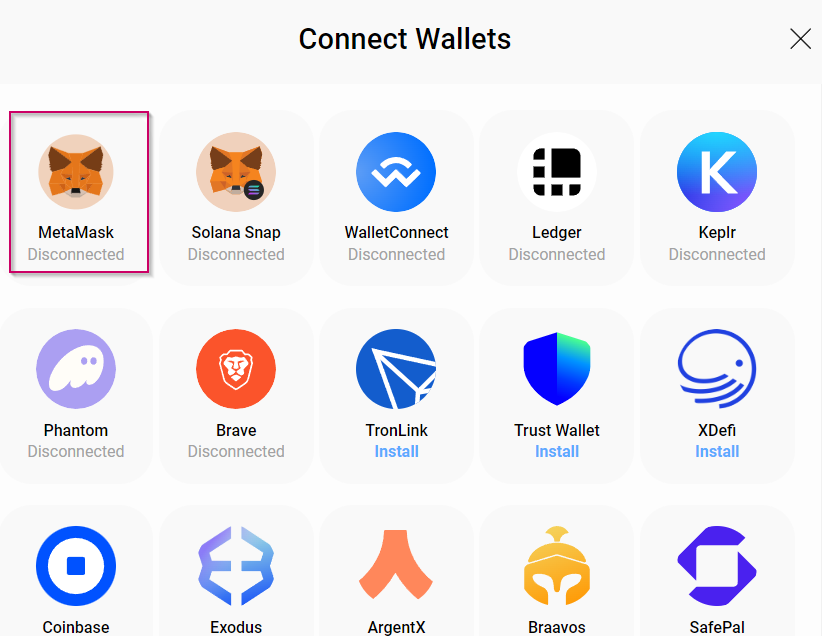

Install MetaMask

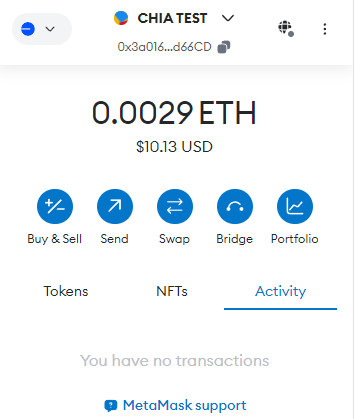

We'll be using the MetaMask wallet on the Base Network.

You can download the Chrome Extension at the following link

Adding BASE to MetaMask

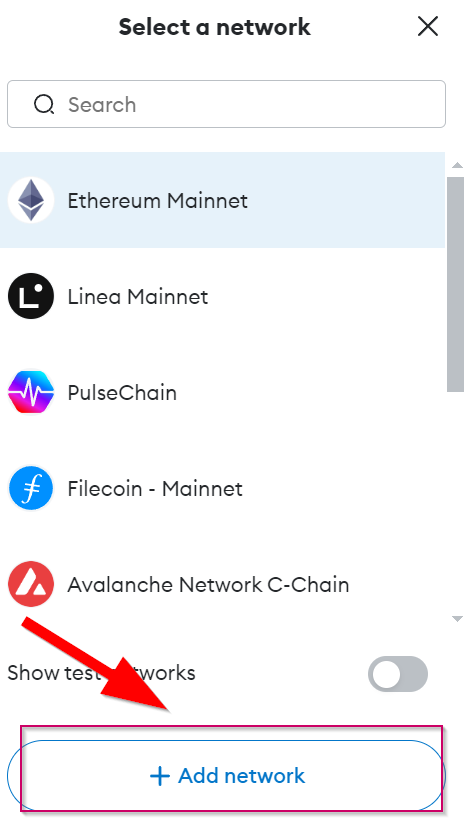

Click the Network Drop Down Arrow and then click Add Network

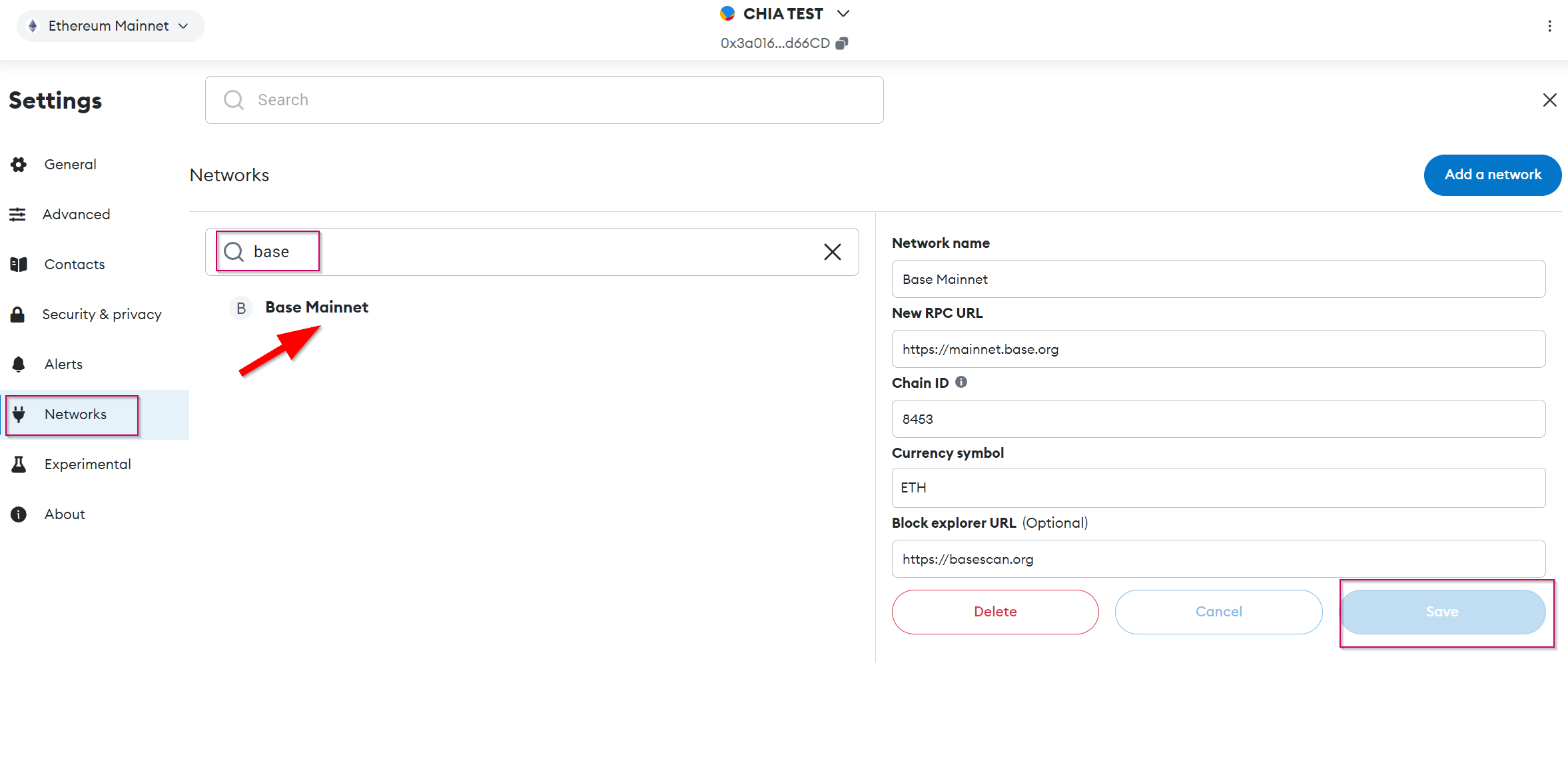

Search for Base Mainnet and click on Save

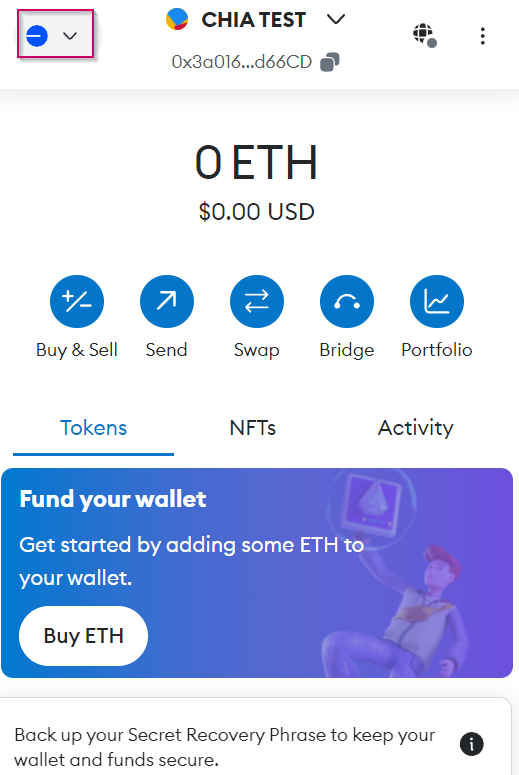

You will see the BASE Logo upon successful completion

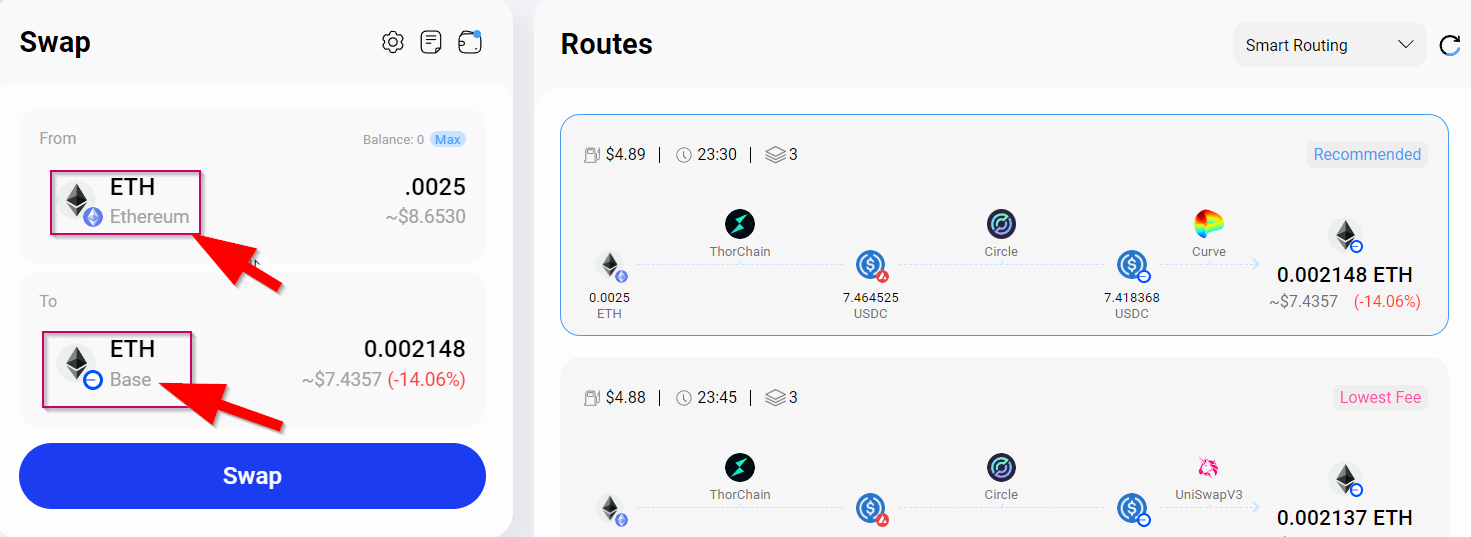

Using Rango to get some wETH for Gas Fees

We'll need some ETH for Gas so we'll use the Rango Exchange which often has the cheapest fees

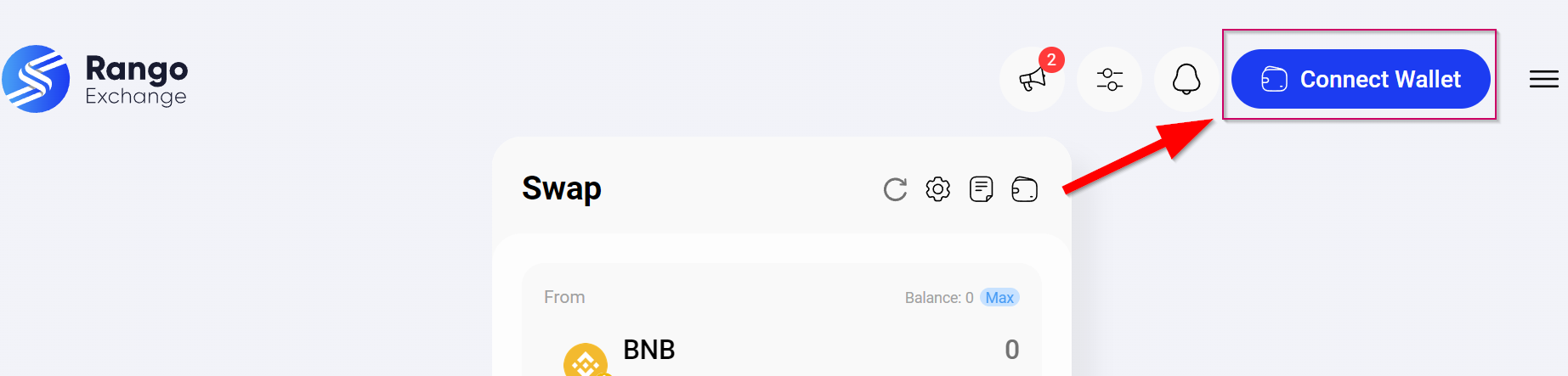

Start by Connecting the Wallet

We'll be using MetaMask

If your ETH is on the Ethereum network, select it as the source and then select BASE as the Destination.

Select the route and complete the SWAP

Once you have some ETH on BASE, we will use it for gas fees.

Bridging XCH to wXCH with Warp.Green

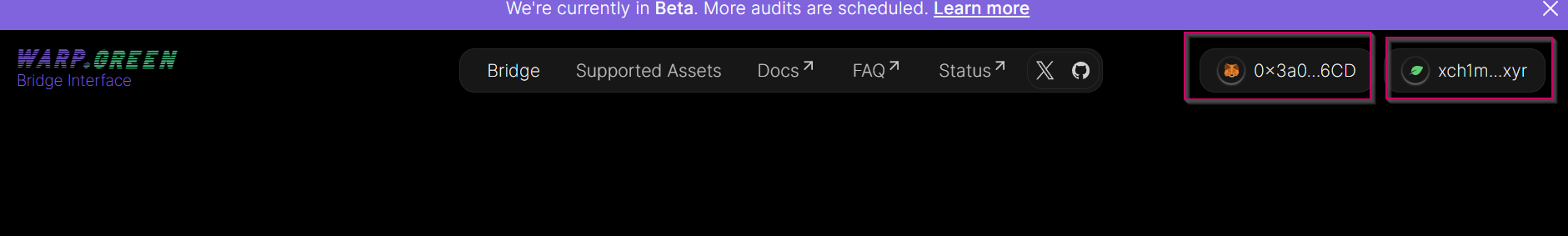

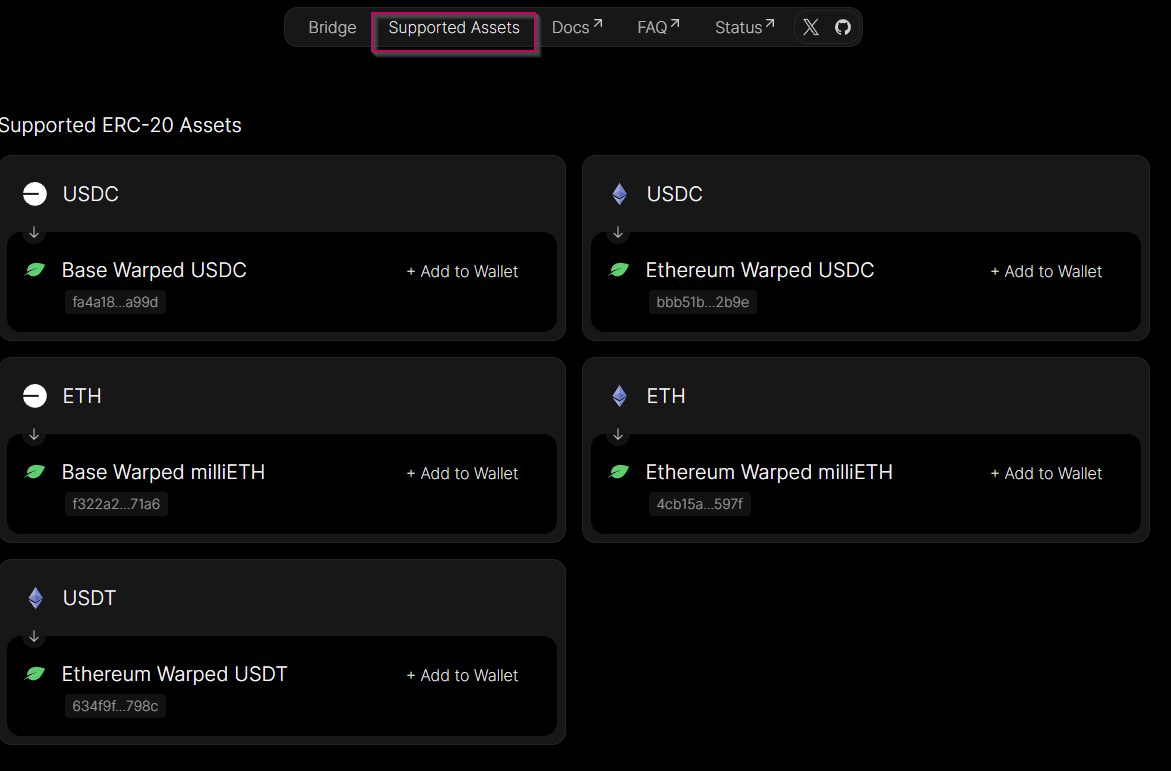

Goto Warp Green and Connect your MetaMask and Goby Wallets

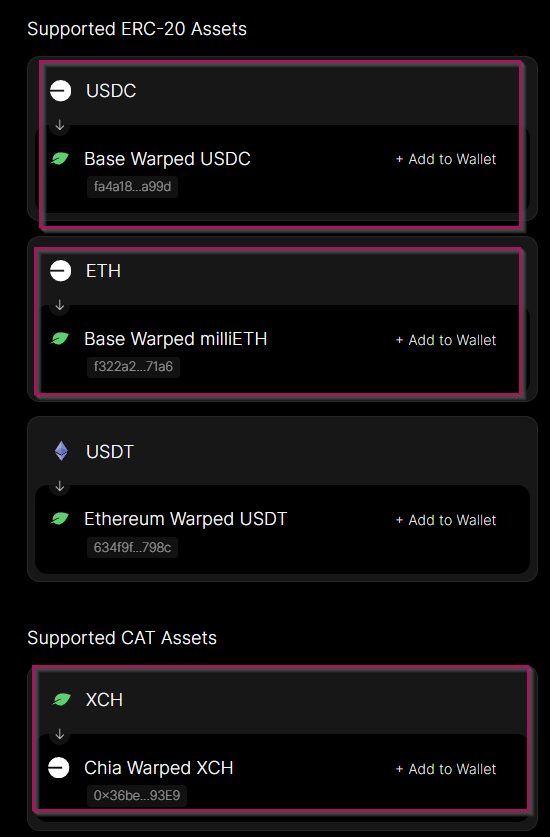

Click on Supported Assets and we'll add the tokens to MetaMask

Let's add BASE USDC, BASE ETH, and BASE wXCH

If you are having trouble adding the USDC Asset on BASE you can type it in manually

0x833589fcd6edb6e08f4c7c32d4f71b54bda02913

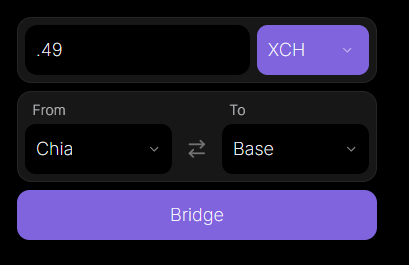

I'll be Warping 0.49 XCH from Chia to BASE

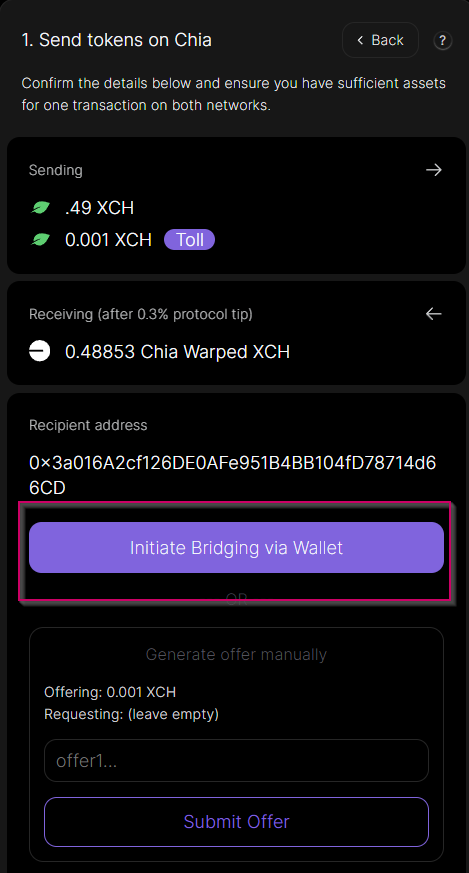

Initiate the Bridge

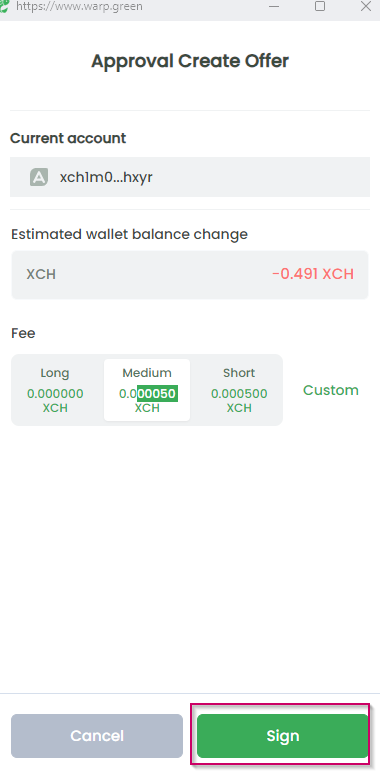

It will ask you to SIGN your transaction on Goby

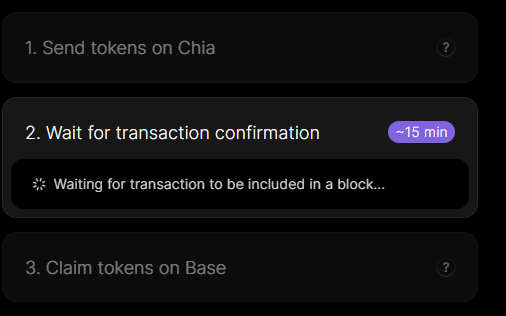

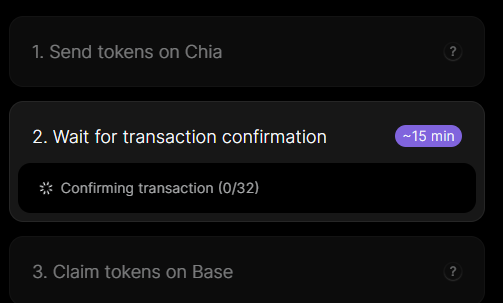

It will take about 15 Minutes to complete the transaction

32 Confirmations are required to to Claim your tokens on BASE

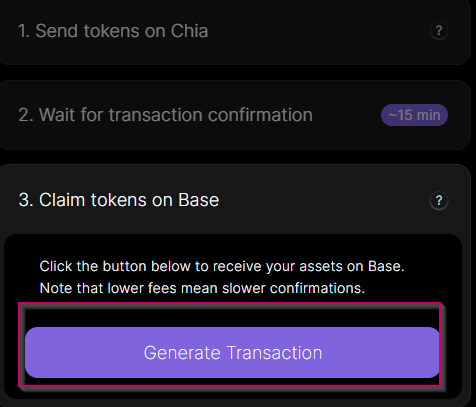

Once completed it will provide a button to Generate a Transaction to claim your asset

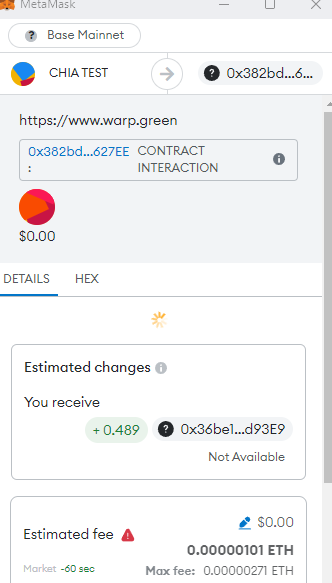

MetaMask will open to sign the transaction

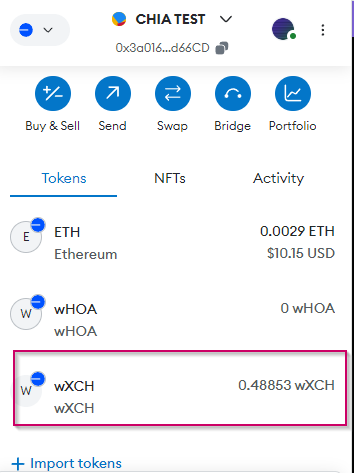

You can then find your wXCH under Tokens

wXCH/USDC Pool

To Provide Liquidity on Aerodrome, visit https://aerodrome.finance/

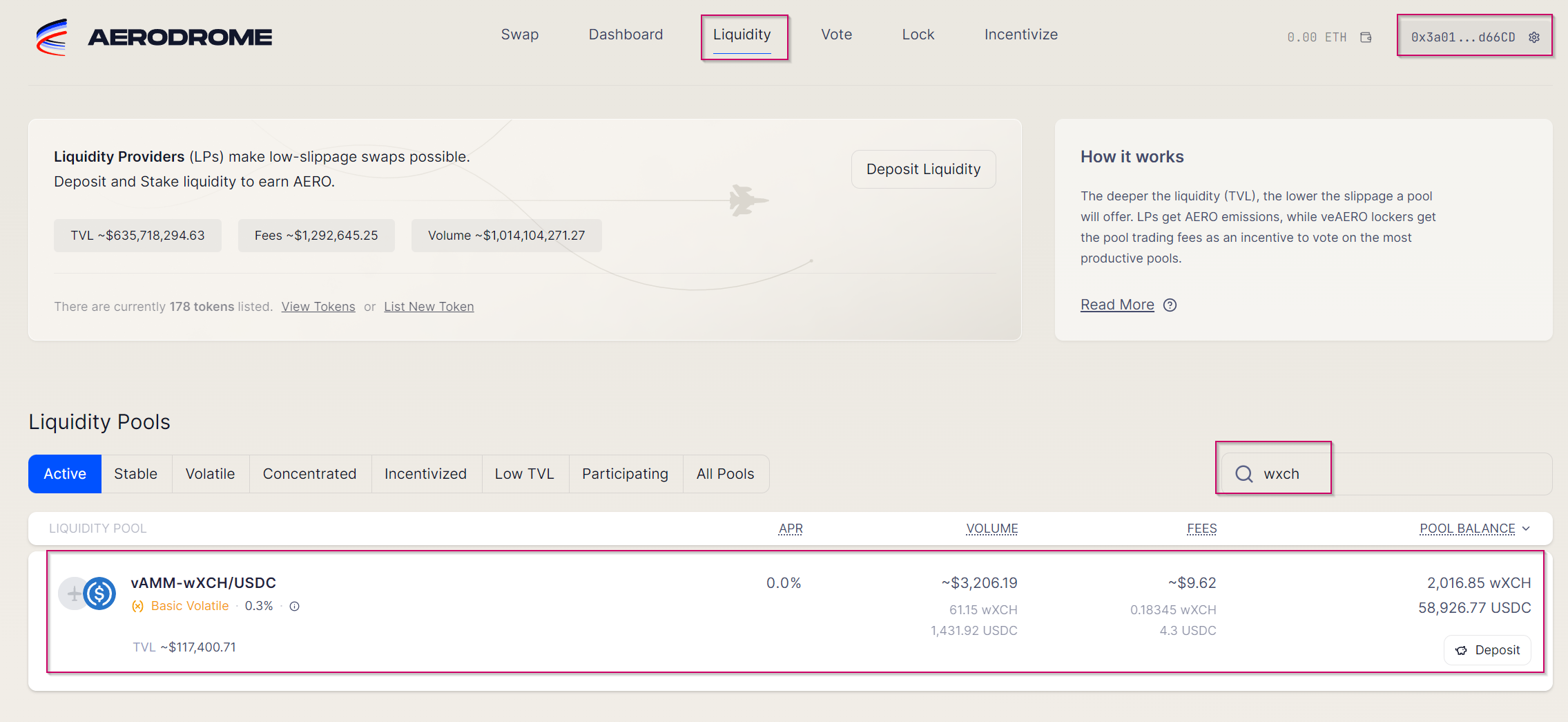

Connect your wallet, click on Liquidity and search for wXCH and find the Pool vAMM-wXCH/USDC

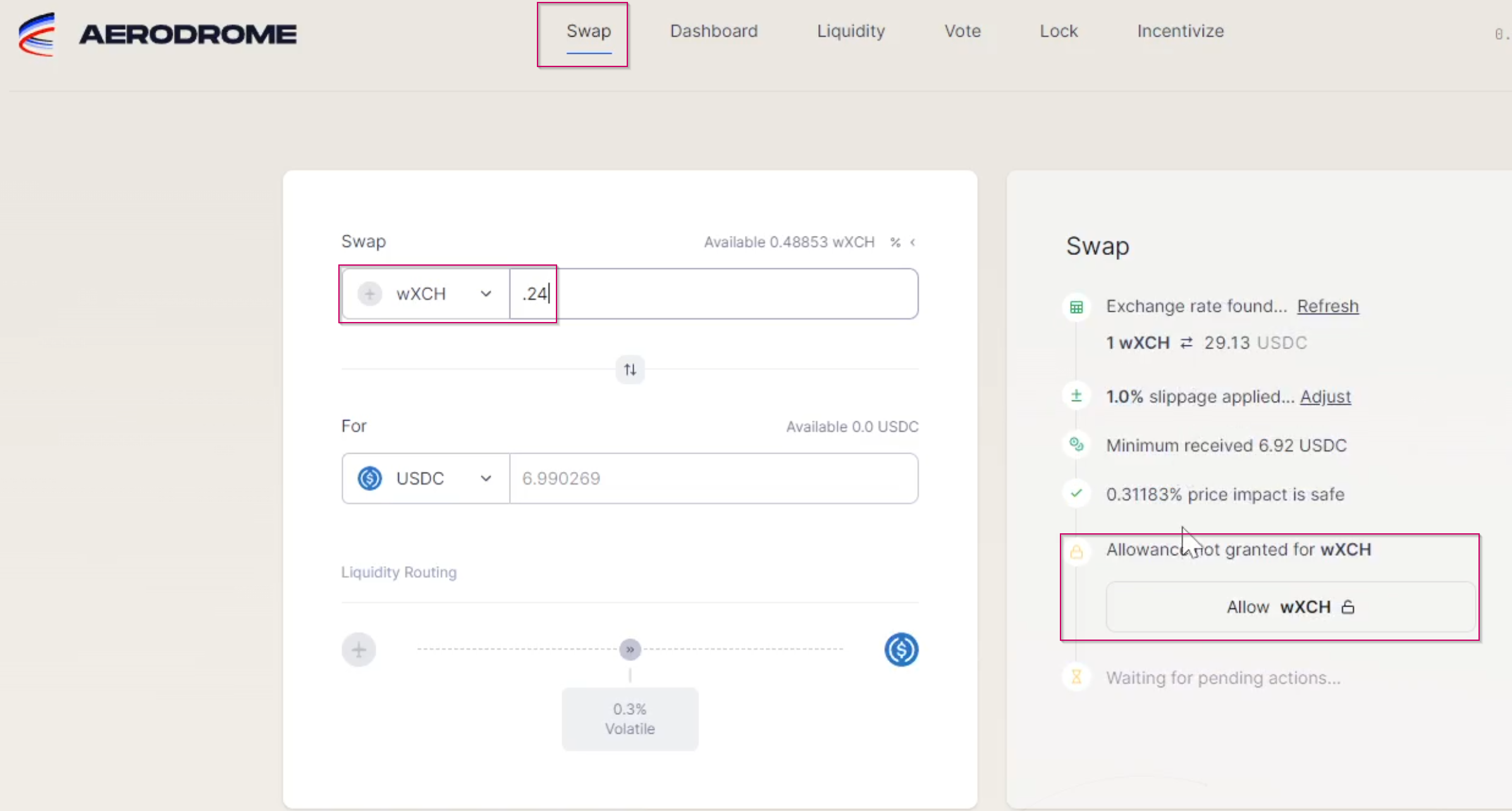

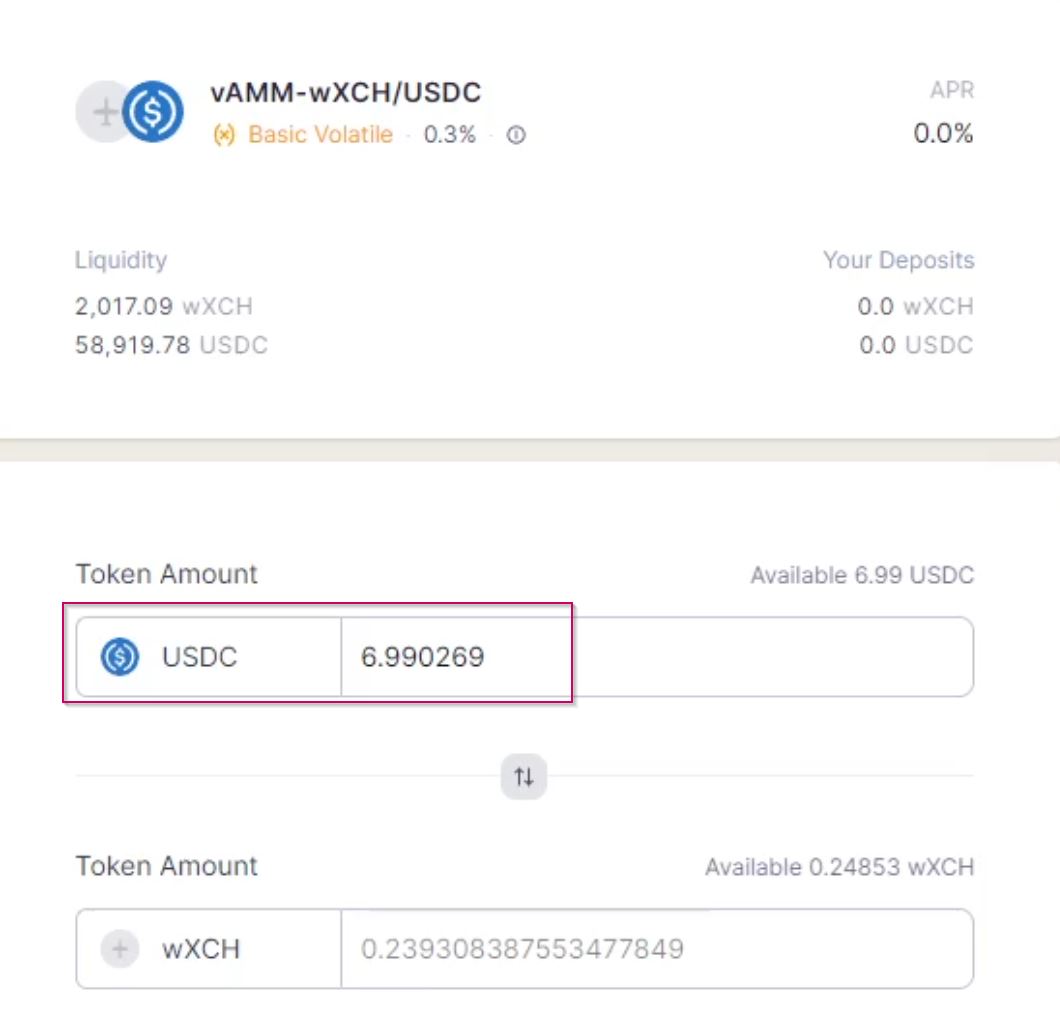

We need to provide equal amounts of wXCH and USDC. Since we don't have any USDC we will swap half out wXCH to USDC

When you enter the amount for one token, it will calculate the equal amount for the other token.

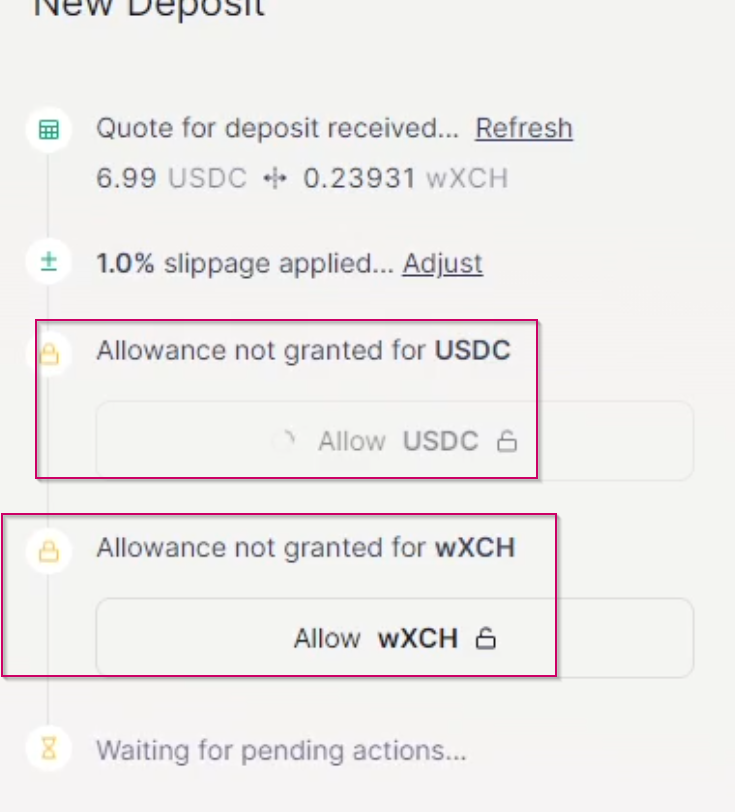

Click on any Allowance Approvals

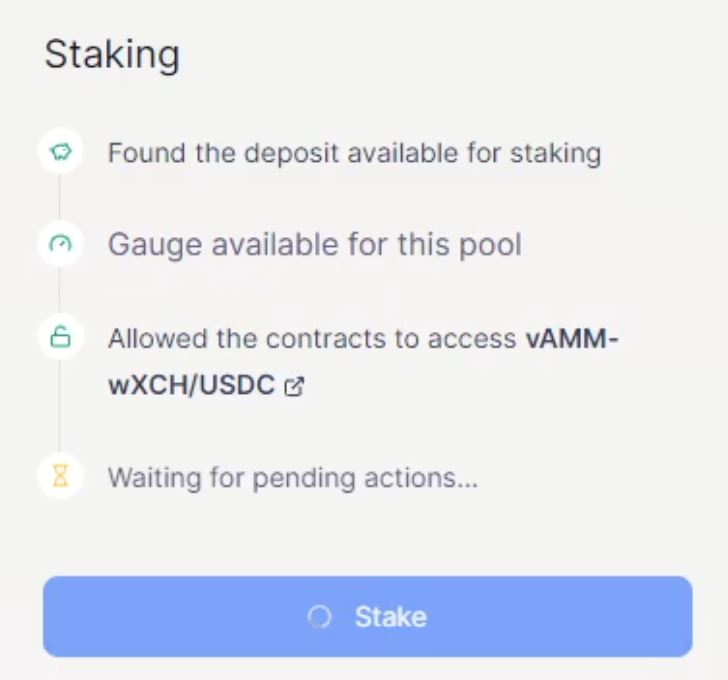

Your Final Step is to STAKE

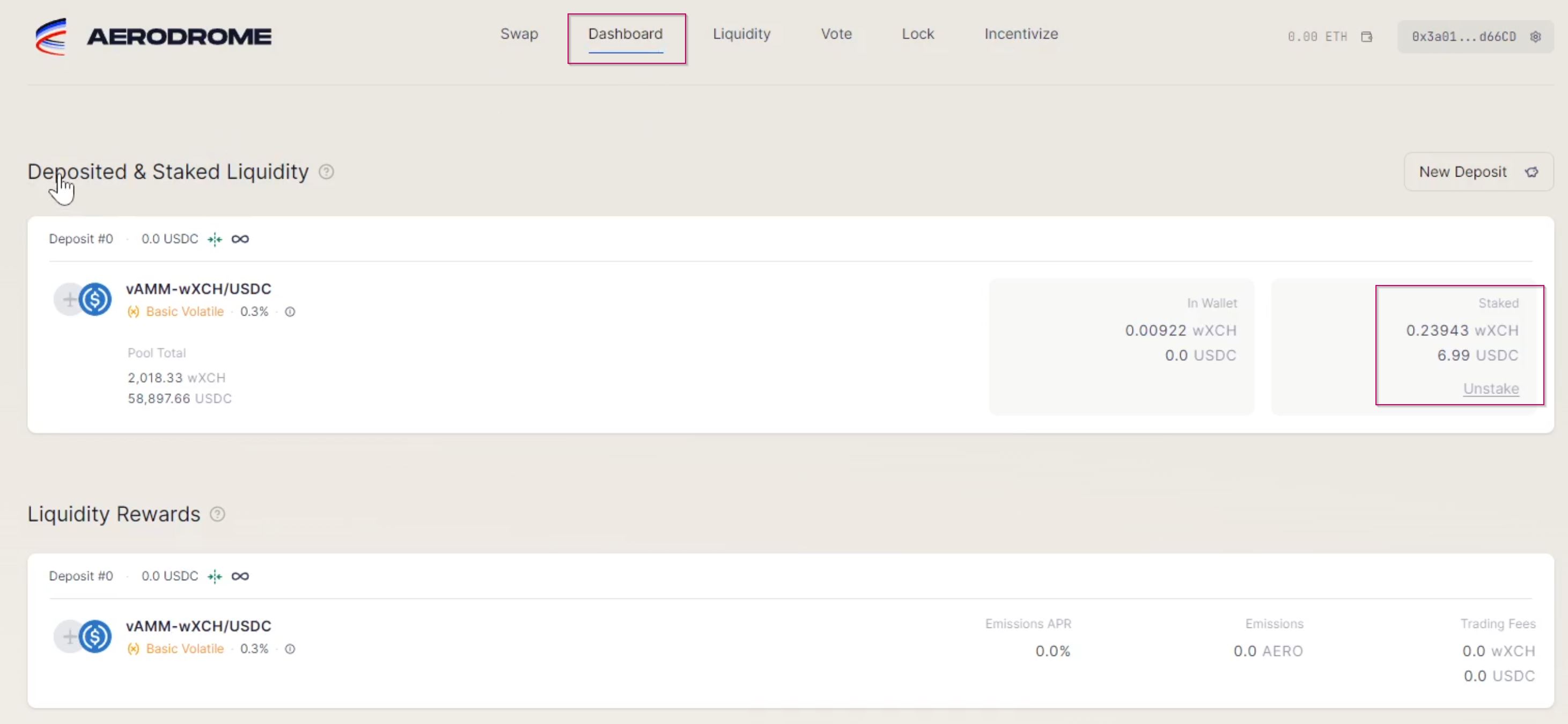

The Dashboard

You can view your Liquidity, unstake, and see your rewards.